Bubbles in world’s housing markets… it depends on Location, location, location….is Malta an exception?

Economist interactive guide to the world’s housing markets

HOUSE prices are going through the roof. They are rising in 18 of the 23 economies that we track. And in eight of them, prices are increasing at a faster pace than three months ago. Yet there are also weak spots, particularly in Europe. Prices in Spain, which had one of the biggest property bubbles before the crisis, are still falling. They have kept declining in France and Italy too. In contrast, housing markets are buoyant in some northern European countries, notably Britain and Sweden, and especially so in their capital cities.

Since some form of recovery was bound to occur after the housing slump, how worrying are the renewed signs of exuberance? To assess whether house prices are at sustainable levels, we use two yardsticks.

- First is affordability, measured by the ratio of prices to income per person after tax.

- Second is the case for investing in housing, based on the ratio of house prices to rents, much as stockmarket investors look at the ratio of equity prices to earnings.

If these gauges are higher than their historical averages then property is deemed overvalued; if they are lower, it is undervalued.

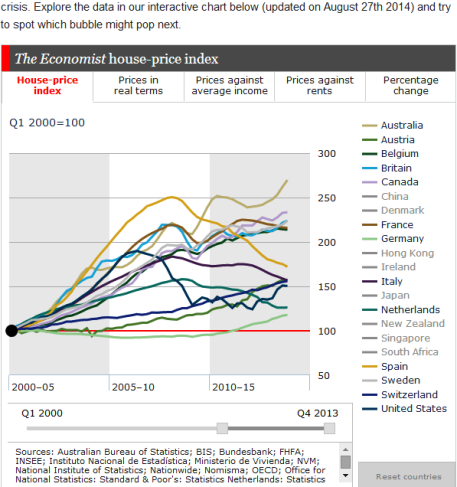

Based on an average of these measures, houses are at least 25% overvalued in nine countries. Judged by rents, the most glaring examples are in Hong Kong, Canada and New Zealand. The overshoot in these economies and others bears an unhappy resemblance to the situation that prevailed in America at the height of its boom, just before the financial crisis. Explore the data in our interactive chart below (updated on August 27th 2014) and try to spot which bubble might pop next

Malta is a small country, at the moment far from the crowds’ minds with a relatively cheaper property’s price…….the limited offer, due to the size, is in strong contrast with an exploding demand driven by 3 factors:

- large global projects and investments in the island

- increasing demand from foreigners, individuals and companies, for living, working, investing, vacation, etc

- steadydemand growth from local people, due to a good buying power and continuous investment in real estate, a real asset almost tax-free, with high cashflow expectations from short and long term lets

http://maltaway.wordpress.com/malta-mercato-immobiliare/

http://www.economist.com/blogs/dailychart/2011/11/global-house-prices?fsrc=nlw|newe|2-09-2014|5356c450899249e1ccb3081a|

One Comment Add yours